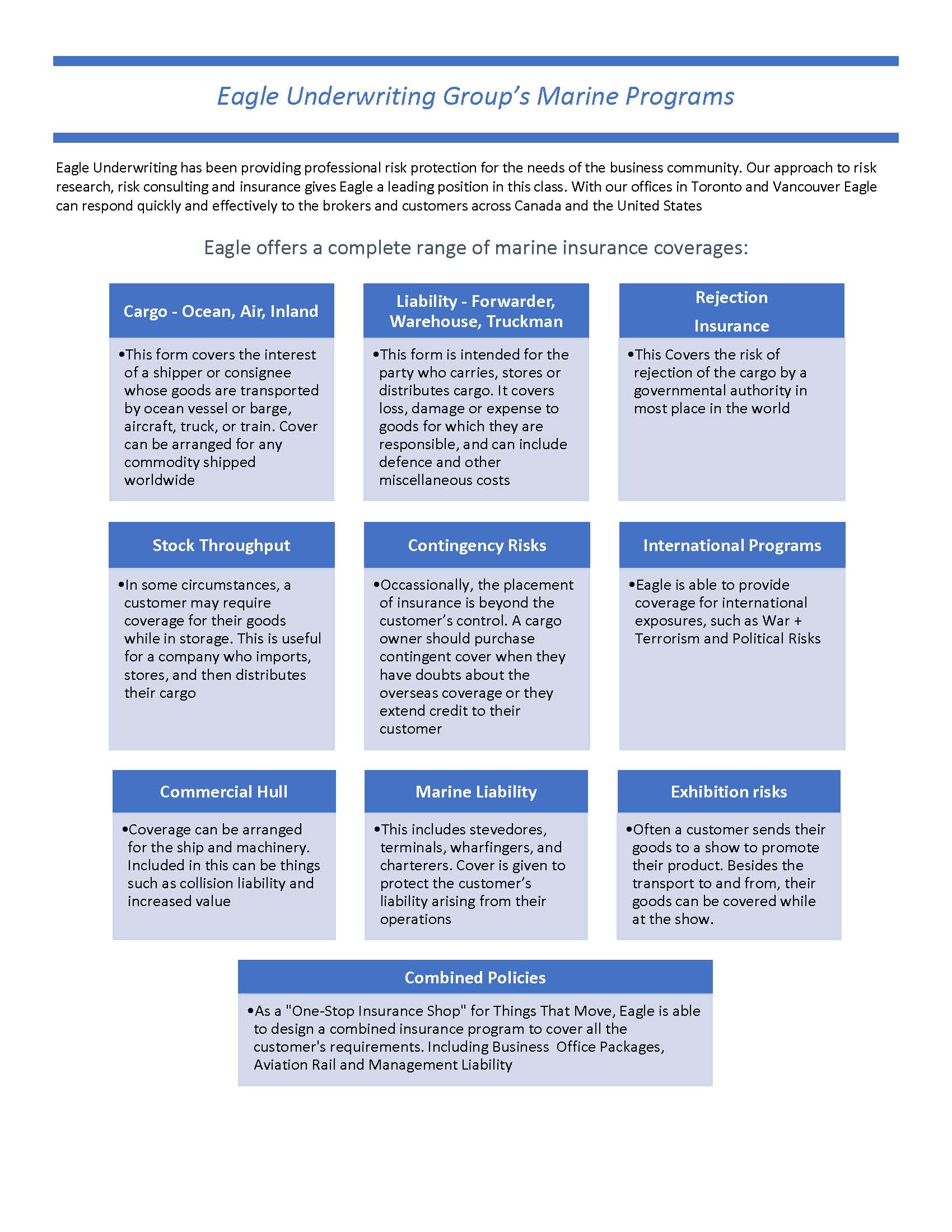

Eagle is honored to announce that they have been acquired by GroupAssur, a Canadian Managing General Agent (“MGA”) specializing in Property and Casualty (“P&C”) insurance lines.

Founded in 1993 by a group of brokers coming together to provide services to larger enterprises, GroupAssur is an MGA servicing specialized insurance needs of brokers and customers across Canada. The company provides underwriting services for complex insurance policies on behalf of Canadian insurance carriers, international insurance carriers, and Lloyd’s of London insurance syndicates.

Since 2020, GroupAssur is owned majority interest by Novacap, one of Canada’s leading private equity firms. Groupassur’s stellar reputation for competitive underwriting initiatives, complemented by Eagles unique service offering and deep industry insight, will provide the company with the resources required to further develop their “Insurance for Things That Move” strategy.

The acquisition is effective October 1st 2021.

Eagle underwriting will continue to operate under their existing structure and brand name. All management, underwriting and claims staff will remain on board, and brokers can expect to see new and enhanced products in the near future.